Press Release

UAE: The Global Powerhouse of Islamic Banking and Finance

UAE has firmly established itself as the global hub of Islamic banking and finance: Zubair Mughal

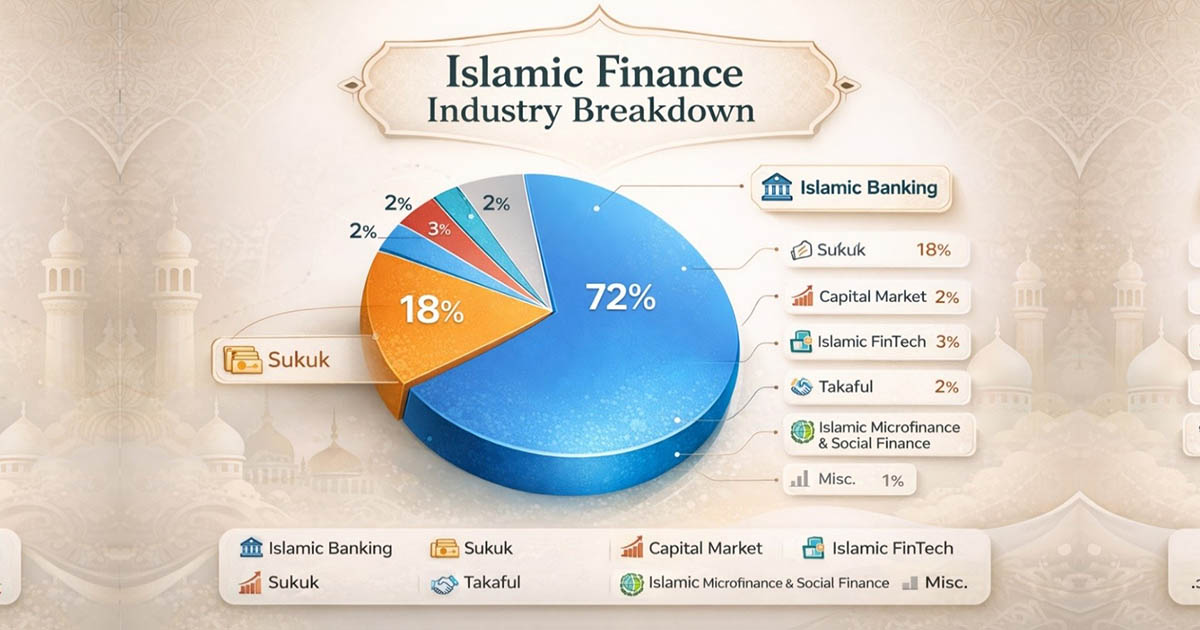

(February 04, 2026 – Dubai, UAE): The UAE has established itself as the global leader in Islamic banking, fintech, Takaful, and capital markets, positioning the country at the forefront of Shariah-compliant finance. The UAE leadership in these sectors is a result of strategic foresight, regulatory excellence, and technological innovation, making the nation the global hub for Islamic financial solutions.

As of 2026, UAE Islamic banking assets have surpassed AED 1.15 trillion with 45 licensed banks, accounting for approximately 25% of the total banking system. This growth trajectory has been driven by the country strong regulatory framework and commitment to Shariah-compliant financial services. The UAE Islamic banking sector has seen double-digit annual growth for the past five years, reflecting its systemic importance and resilience.

The government’s long-term strategy remains equally ambitious. National targets to expand Islamic banking assets toward AED 2.56 trillion by 2031 continue to guide policy, capital formation, and institutional development, reinforcing Dubai’s role as the anchor of the global Islamic financial ecosystem.

The Islamic fintech sector in the UAE is thriving, with the country quickly emerging as a global leader in Shariah-compliant digital solutions. By 2026, the UAE has witnessed the launch of over 30 fintech startups, offering innovative solutions in digital payments, peer-to-peer financing, crowdfunding, and Islamic digital currencies. These developments have enabled financial inclusion across Muslim populations and are creating new investment opportunities for global investors. The sector is maturing into "institution-grade infrastructure" to reach a projected $6.43 billion by 2030.

Takaful, the Islamic alternative to conventional insurance, has become a major component of the UAE’s Islamic finance landscape, and takaful market has reached around USD 200 million. The market is rapidly embracing digital platforms, streamlining processes such as claims management and policy issuance. The country’s regulatory framework ensures transparency and customer protection, fostering a dynamic, customer-focused Takaful market. Takaful providers in the UAE are now exploring new models, including family Takaful, health insurance, and general insurance, while maintaining full compliance with Shariah principles.

The UAE is recognized as the global leader in Islamic capital markets, particularly in the issuance and listing of Sukuk (Islamic bonds). Currently, the Nasdaq Dubai platform has USD 101 billion in outstanding Sukuk listings, making it one of the largest venues for Sukuk in the world. The UAE continues to play a pivotal role in green sukuk, aligning with the global sustainability agenda and attracting international investors.

In line with global trends, the total Sukuk market is expected to exceed USD 1.5 trillion by 2026, with the UAE serving as a primary gateway for issuers from Asia, Africa, and the Middle East seeking global capital.

Mr. Muhammad Zubair Mughal, CEO, AlHuda CIBE states that: “UAE has firmly established itself as the global hub of Islamic banking and finance, backed by strong regulation, market depth, and sustained innovation. Its leadership in Islamic banking assets, sukuk markets, and sustainability-linked finance reflects a mature ecosystem that continues to set global benchmarks.” “At AlHuda CIBE, we view UAE as a critical platform for advancing Islamic finance education, advisory, and cross-border collaboration, connecting emerging markets with the global Islamic financial industry.”

The UAE regulatory environment is a key pillar of its leadership in Islamic finance. The Dubai International Financial Centre (DIFC) continues to serve as a top choice for international Islamic finance institutions, offering a common law framework and ensuring full foreign ownership. At the federal level, the Central Bank of the UAE is modernizing financial systems with initiatives such as open finance frameworks, real-time payment systems, and digital currencies, ensuring the UAE Islamic financial sector remains ahead of the curve.

Sustainability has become a core feature of Islamic finance in the UAE. Most UAE-based Islamic banks have adopted ESG (Environmental, Social, and Governance) principles, aligning Shariah law with global sustainability goals. UAE institutions are pioneering sustainability-linked Islamic finance structures, ensuring that green sukuk and other Shariah-compliant financing options contribute to the global green economy. The UAE strategic geographic location at the crossroads of Asia, Europe, and Africa amplifies its role as a cross-border hub for Islamic finance. With world-class infrastructure and robust financial ecosystems, the UAE serves as a natural gateway for Islamic trade, finance, and investment.

The UAE Capital of Islamic Economy vision integrates Islamic finance with other sectors such as halal trade, tourism, food, and lifestyle, reinforcing the nation’s position as a global leader in Islamic finance.

About AlHuda CIBE:

AlHuda Center of Islamic Banking and Economics (CIBE) is a well-recognized name in Islamic banking and finance industry for research and provide state-of-the-art Advisory Consultancy and Education through various well-recognized modes viz. Islamic Financial Product Development, Shariah Advisory, Trainings Workshops, and Islamic Microfinance and Takaful Consultancies etc. side by side through our distinguished, generally acceptable and known Publications in Islamic Banking and Finance.

We are dedicated to serving the community as a unique institution, advisory and capacity building for the last twelve years. The prime goal has always been to remain stick to the commitments providing Services not only in UAE/Pakistan but all over the world. We have so far served in more than 100 Countries for the development of Islamic Banking and Finance industry. For further Details about AlHuda CIBE, please visit: www.alhudacibe.com.

For Media Contact:

Ms. Shaguftta Perveen

Manager Communications,

info@alhudacibe.com

Call: +971 52 865 5523